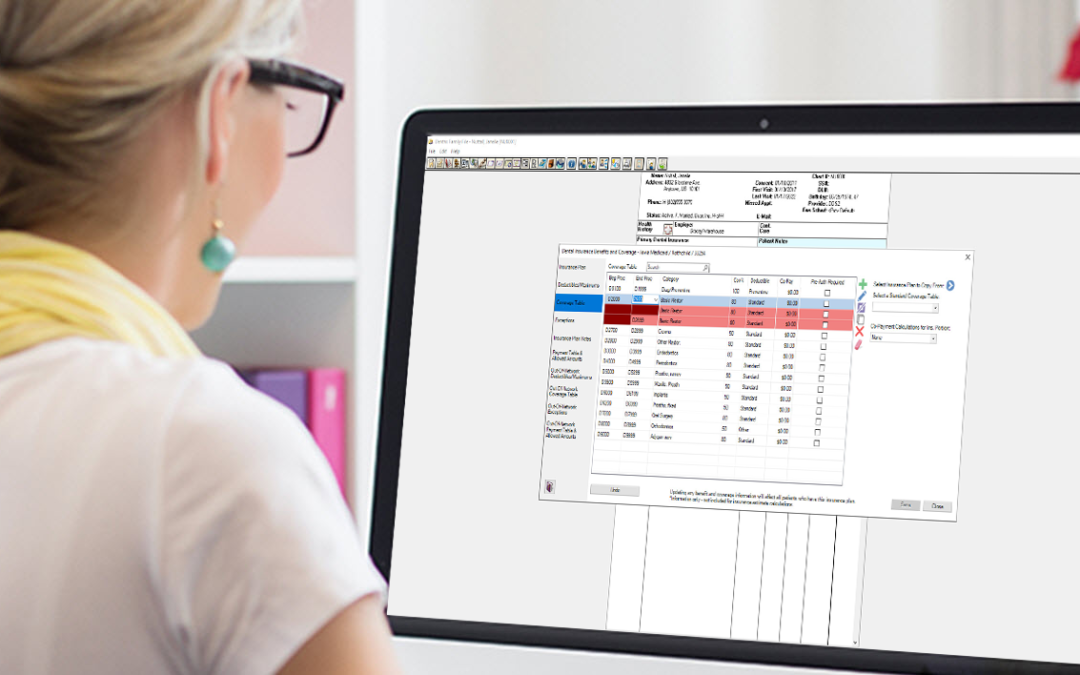

The insurance coverage table in Dentrix is a powerful tool that helps you provide accurate cost estimates when you present a treatment plan to a patient. However, the coverage table is only as accurate as the information you put into it.

One of the features in the new Dental Insurance Benefits and Coverage dialog box is the ability to easily split up coverage categories when there is a different coverage for procedures within the category.

For example, you may have an insurance carrier that has different coverage percentages for crowns and build-ups. You’ll want to edit the coverage table for that carrier to reflect these different coverage percentages, so your treatment estimates are accurate.

Let’s assume that the coverage table for the ABC Insurance Company is currently set up in Dentrix with the procedure codes D2700 – D2999 listed in the Crowns/Major Restor category, each covered at 50%, with a Standard deductible. However, you need to split that set of codes into these three groupings:

- Procedures D2700 – D2949 , Category: Crowns/Major, covered at 50% with a standard deductible

- Procedure D2950, Category: Build Up, covered at 80% with a standard deductible

- Procedures D2951 – D2999, Category: Crowns/Major, covered at 50% with a standard deductible

It’s now easier than ever to split a coverage table category to document these differences. Here’s how:

- From the Office Manager, select Maintenance > Reference > Insurance Maintenance.

- From the list of insurance carriers, select the insurance company whose coverage table you need to edit, and click Benefits/Cov.

- Select the Coverage Table tab on the left.

- In the coverage table, select the category to be split, and click the Split button.

- Enter new ranges of beginning and ending procedure codes, update procedure category names, coverage percentages, and deductible types as needed.

- Click Save to save the changes to the coverage table.

Additional Information

- Watch the Dentrix G7.4 Insurance Improvements video, particularly the portion dealing with the Coverage Table section starting at the 1:55 time mark.

- For more detail, see the Splitting Coverage Table Categories topic in Dentrix Help.